Get Started with the Best Gold IRA Custodian Reviews

Compare the Best Gold IRA Companies – The Top Gold IRA Custodian Reviews of 2025 and 2026

Navigating the maze of best gold IRA companies and reading honest gold IRA reviews in 2025 and 2026 doesn’t have to be stressful. Whether you're worried about inflation, rising national debt, or market volatility, protecting your retirement savings with a precious metals IRA is a time-tested approach.

The trusted firms listed below have earned their spots through transparency, expertise, and customer-first service. If you're looking for the best gold IRA company to partner with, start with the top gold ira custodian reviews here.

How to Begin Comparing Gold IRA Providers

Our gold IRA custodian reviews should be just the starting point for you, as you can and should talk to each firm you're considering. Particularly, all top-ranked companies provide educational packages to get you up to speed.

In addition, they offer complimentary consultations so you can discuss details and have your questions answered. Please note that reputable firms in this space always provide these services free of charge.

However, if a firm does not offer these free services, it may suggest a lack of establishment or customer focus.

2025–2026 Gold IRA Company Comparison Guide

These gold ira custodian reviews represent the industry's cream of the crop when it comes to quality service, dollar value, and professionalism, and the Gold IRA Custodian Reviews team fully recommends ANY of the following companies when you are looking to diversify, hedge, and protect your hard-earned savings against inflation, national debt, and market volatility with a tax-advantaged self-directed gold IRA from one of the best gold IRA companies in the nation.

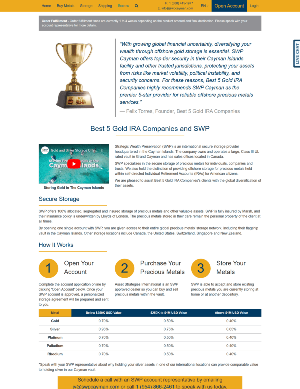

| Gold IRA Company | What They're Best For | Minimum Investment | Storage Type | BBB Rating | Ranking |

|---|---|---|---|---|---|

| Augusta Precious Metals | Best Overall | $50,000 | Segregated | A+ | #1 |

| Goldco | No Minimum Required | $0 | Segregated or Commingled | A+ | #2 |

| Lear Capital | Longevity | $10,000 | Commingled | A+ | #3 |

| Birch Gold Group | Affordability | $10,000 | Segregated or Commingled | A+ | #4 |

| American Hartford Gold | Service | $10,000 | Segregated | A+ | #5 |

| GoldenCrest Metals LLC | Semifinalist | $25,000 | Commingled | A | #6 |

| Priority Gold | Semifinalist | $5,000 | Commingled | A | #7 |

| Colonial Metals Group | Semifinalist | $20,000 | Commingled | NR | #8 |

In addition, each of these top-rated gold IRA firms offers IRS-approved metals, secure storage options, and guidance through the rollover process.

What Makes These Gold IRA Firms Stand Out

Each of these firms has earned its place among the best IRA companies for gold by offering IRS-approved metals, transparent pricing, and expert guidance throughout the gold IRA rollover process.

How We Ranked the Top Firms

Anytime you’re dealing with money, it's critical to do your research to pick the best possible firm to do business with.

To begin with, selecting a precious metals dealer can prove challenging, as most major brokerage firms do not offer this service. Consequently, when conducting our top gold IRA custodian reviews for July, 2025, we factored in these specific criteria…

What We Looked for in a Gold IRA Company

- Established track record: Now is not the time to take risks with new businesses or persuasive salespeople. Instead, seek out firms with a proven history, a substantial base of satisfied customers, and minimal customer complaints. Be sure to check the Better Business Bureau and other independent consumer protection websites for additional insights.

- Transparency: Clarity and upfront disclosure of costs are paramount. However, not all dealers provide equal transparency. If a firm hesitates or fails to provide clear, prompt answers to your fee inquiries, consider it a potential warning sign. Transparency indicates a well-established business unafraid of competition, ensuring that unexpected fees do not catch you off guard.

- Emphasis on education: Precious metals sales require specialized expertise. Therefore, companies offering this service should prioritize education over meeting sales quotas. If you sense a pushy sales approach, it may signal that the firm's core business health is not optimal. Indeed, the top gold IRA companies always prioritize customer education.

- Proactive customer service: When establishing your Gold IRA, you need a firm that can guide you through the process to ensure accuracy. Look for a company known for delivering exceptional customer service. Otherwise, you may question the validity of your investment. Moreover, you do not want to discover, two decades later, that the expected tax benefits are not forthcoming. As a result, they’ve earned high marks from customers.

Transparent Pricing, Experience, and Service

These top gold IRA companies were ranked based on transparent pricing, experience, and service — three critical pillars of any smart gold IRA investment.

For example, see how the best gold IRA companies of 2025 stack up in our side-by-side gold IRA comparison.

International Gold Dealer Choice for Offshore Privacy and Security

Ultimately, these Gold IRA reviews are here to help you make an informed, confident decision. Each company offers a free consultation and investor kit, making it easy to compare their offerings before you commit. The firms listed are consistently rated among the top gold IRA companies of 2025 and are recognized for their transparency, reliability, and customer support.

Gold IRA Frequently Asked Questions

Whether you're evaluating gold IRA rollover companies or comparing the most trusted gold IRA providers in 2025 and 2026, the FAQs below will help you make a confident and informed decision.

What is a Gold IRA?

A Gold IRA is a self-directed retirement account that allows individuals to invest in physical gold and other IRS-approved precious metals while benefiting from tax-deferred or tax-free growth, and is often set up with help from a top-rated gold IRA firm that specializes in physical precious metals.

Can I roll over my 401(k) into a Gold IRA?

Yes, you can roll over a 401(k), 403(b), TSP, or other qualified retirement accounts into a Gold IRA without triggering taxes or penalties when done correctly.

What are the benefits of a Gold IRA?

Gold IRAs offer portfolio diversification, protection against inflation, and economic stability. They allow you to hold physical precious metals inside a tax-advantaged retirement account.

What types of metals can I hold in a Gold IRA?

You can hold IRS-approved gold, silver, platinum, and palladium coins and bars that meet minimum fineness standards and are minted by approved entities such as COMEX or national mints.

Can I store Gold IRA metals at home?

No. IRS rules require that all Gold IRA assets be stored with a qualified custodian or depository. Home storage may result in disqualification of the IRA and tax penalties.

What are the fees associated with a Gold IRA?

Gold IRAs typically involve a one-time setup fee, annual account maintenance fees, and secure storage fees. Reputable companies disclose all costs up front.

Can I start a Gold IRA with gold I already own?

No. The IRS does not allow you to fund a Gold IRA with metals you already own. Contributions must be made in cash or through a rollover from another qualified retirement account.

Final Thoughts on Choosing a Reliable Gold IRA Provider

In conclusion, each company listed here in our gold IRA custodian reviews and gold IRA company ratings provides a no-obligation free consultation and educational gold IRA and gold investing guides, at NO cost and NO obligation to you, to answer your questions. That’s why we only feature trusted names.

You'll have what you need to make an informed decision when it comes to protecting your retirement savings against unforeseen events like the 2007–2008 financial crisis. Best wishes now and always.